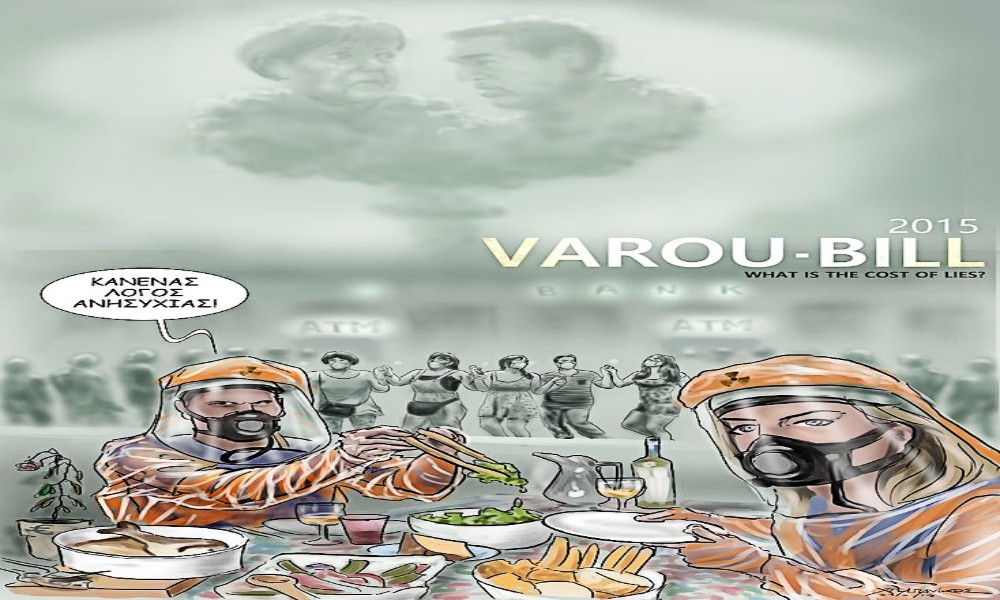

Το “Έπος” του 2015 και άλλα συμβάντα της 30ης Ιουνίου :

Μικρή ιστορική αναδρομή σε πράξεις, λόγια και γεγονότα που εκτυλίχθηκαν την συγκεκριμένη μέρα στο “απολύτως επικό” αρχικό διάστημα της πρώτης φοράς της αριστεράς

Παρακολουθήστε τον pluralismos.gr και τις καθημερινά προγραμματισμένες ιστορικές αναδρομές του…και ανατρέξτε στο αρχείο του

σκίτσο εξωφύλλου : Χρήστος Παπανίκος – σκίτσα

-

Former Fed governor Larry Lindsey and Southern Co. boss Tom Fanning, chair of the Atlanta Fed’s board of directors, talk about their reasons for seeing a possible delay.

-

Lawrence Lindsey, The Lindsey Group CEO, discusses why he is skeptical Greece is likely to work out a deal with the EU and weighs in on the pros and cons of Greece exiting the euro.

-

CNBC’s Michelle Caruso-Cabrera reports Germany’s chancellor is open to continue talks with Greece but adds the bailout program expires at midnight.

-

Kristina Hooper, Allianz Global Investors, shares her long-term play on equities, as bonds take a hit and uncertainty spreads across Europe.

-

While the Greek default deadline looms, reports are surfacing Tsipras is considering a last-minute deal, reports CNBC’s Michelle Caruso-Cabrera.

-

Michael Zinn, UBS Wealth Management senior v.p., and Joseph LaVorgna, Deutsche Bank, share their thoughts on the financial stability of the euro zone as creditors knock on Greece’s door. You have to have a way to collect taxes, says LaVorgna.

-

Larry Summers, Harvard University, shares his thoughts on whether Greece can be saved and what would likely happen if Greece left the euro zone.

-

Greece is on the verge of default as a critical payment comes due today, reports CNBC’s Michelle Caruso-Cabrera.

-

Antigoni Lyberaki, a member of the Greek parliament for To Potami, discusses the political situation in Greece ahead of the bailout referendum.

-

Societe Generale’s Kokou Agbo-Bloua discusses European markets and Greece’s capital controls.

-

Martin Gilbert, CEO of Aberdeen Asset Management, says unintended consequences of events like a potential Greek default will dislocate markets.

-

Alastair Newton, senior political analyst at Nomura, discusses the hyperbole surrounding the Greek debt deal and upcoming referendum.

-

Moritz Kraemer, chief rating officer for sovereign ratings at S&P, says the agency is running out of notches to rate Greece.

-

Bernard Charles, CEO of Dassault Systemes, says product planning is unlikely to be affected by a potential Greek exit from the euro zone.

-

Larry McDonald, Societe Generale Managing Director and Head of U.S. Strategy, weighs in on Greece contagion fears.

-

Michael Farr; Farr. Miller & Washington President; weighs in on the latest developments on the Greece crisis.

-

CNBC’s Michelle Caruso-Cabrera reports that German leader, Angela Merkel, states “We will not negotiate on anything new before referendum.”

-

President Obama holds a joint press conference with Brazil President Rousseff in the East Room and answers questions regarding the financial crisis in Greece.

-

CNBC’s Michelle Caruso-Cabrera reports on the latest developments from Greece and their aid dilemma.

-

Hendrik du Toit, CEO of Investec Asset Management, discusses the impact of Greece and its upcoming referendum will have on markets.

-

Filippo Taddei, chief economic advisor to Partito Democratico in Italy, discusses what market and labour reforms are needed in Greece.

-

Antonio Garcia Pascual, Barclays chief euro area economist, weighs in on Greek drama as it continues to unfold.

-

Stathis Kouvelakis, Syriza central committee member, predicts that the Greek people will vote “no” in this weekend’s referendum.

-

Justin Knight, head of European rates strategy for UBS, discusses Greece’s request for a new 2-year bailout program.

-

Ben Steil, Council on Foreign Relations, discusses Greek default worries and the referendum vote.

-

Will Puerto Rico or Greece prove to be a bigger systemic threat? John Chambers, S&P head of Sovereign Ratings, discusses the debt issues.

-

CNBC’s Michelle Caruso-Cabrera reports according to Greek television some ATMs are only dispensing 50 euro bills while the limit is supposed to be 60 euros, as the debt deadline looms.

-

With Greece-related risks priced in, a below-view U.S. nonfarm payrolls report this week could give the euro a leg-up, says Jeffrey Halley, senior manager of FX Trading at Saxo Capital Markets.

-

Josef Stadler, head of Global Ultra High Net Worth (UHNW) at UBS, says the ultra-wealthy around the world are not overly worried over Greece which has a limited contagion risk.

-

At the moment, global investors seem to view market setbacks as catalysts to put more money into the markets, says Jim Sarni, managing principal at Payden & Rygel.

-

Thousands of people rallied in Athens on Tuesday in support of a bailout deal with the country’s international creditors. CNBC’s Julia Chatterley reports.

-

Austan Goolsbee, professor of Economics at University of Chicago’s Booth School of Business, discusses St. Louis Fed President James Bullard’s remarks on Greece and how it may affect the U.S. economy.

-

With or without a deal, Greece remains in a tough spot, says Austan Goolsbee, professor of Economics at University of Chicago’s Booth School of Business.

-

Steve Hanke, co-director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore, questions Greece’s ability to hold a referendum on July 5.

-

Pete Benson, partner at Beacon Capital Management, explains whether the Greek crisis could change the Fed’s timeline for raising interest rates.

-

Stephanie Flaunders, JPMorgan chief market strategist, shares her forecast for the worst case scenario in the markets regarding Greece’s debt crisis.

-

The “Fast Money” traders dive into the market action as Greece and Puerto Rico struggle with debt issues.

-

Greece’s bailout program expires tonight, reports CNBC’s Michelle Caruso-Cabrera.

-

Julian Robertson, Tiger Management founder, says in terms of the world, Greece is not an economic power, in discussing potential contagion if Greece leaves the euro zone, and investing in Europe.

-

Catherine Rampell, The Washington Post, discusses the potential fallout if Greece were to leave the euro zone.

-

Plenty of countries around the globe have debt issues besides Greece. Kevin Giddis, Raymond James, provides perspective.

-

CNBC’s Michelle Caruso-Cabrera reports from Athens, where thousands gathered earlier saying they want Greeks to vote “yes” on the referendum Sunday.

-

The latest on a possible Greek exit from the euro, with CNBC’s Michelle Caruso-Cabrera.

-

The latest on Greece’s proposal to creditors, with CNBC’s Michelle Caruso-Cabrera, who also speaks with a business owner.

Markets are expecting the Greeks to vote “yes” in the July 5 referendum and even if a “no” vote materializes, the contagion will be under control, says Tim Seymour, CIO at Triogem Asset Management.

Δείτε τις καθημερινές ιστορικές αναδρομές του pluralismos.gr

Sources/Πηγές: ΕΡΤ, Τηλεοπτικός Σταθμός της Βουλής των Ελλήνων, pluralismos.gr, mini.press, ThePressRoom, DW Ελληνικά, StarTvGreece, CNBC, Bloomberg και Ασοσιέιτεντ Πρες